DOT KITCHEN DOT Kitchen integrates perfectly into the kitchen environment, quickly becoming indispensable in your daily work.

CAPTURE THE ATTENTION OF STAFF

DOT Kitchen is specifically designed for the kitchen environment.

To capture the attention of the kitchen staff, DOT Kitchen emits acoustic signals (which can be disabled if necessary) to identify:

- incoming orders

- the starlings

- reset procedures

The strength of DOT printers lies in their exceptional robustness and reliability: They adapt perfectly to all situations and are resistant to dust, smoke, and splashes.

- ultra-compact and robust

- automatic rotary opening

- high quality printing and components

- simplified operations

- anti-blocking and anti-jamming guarantee

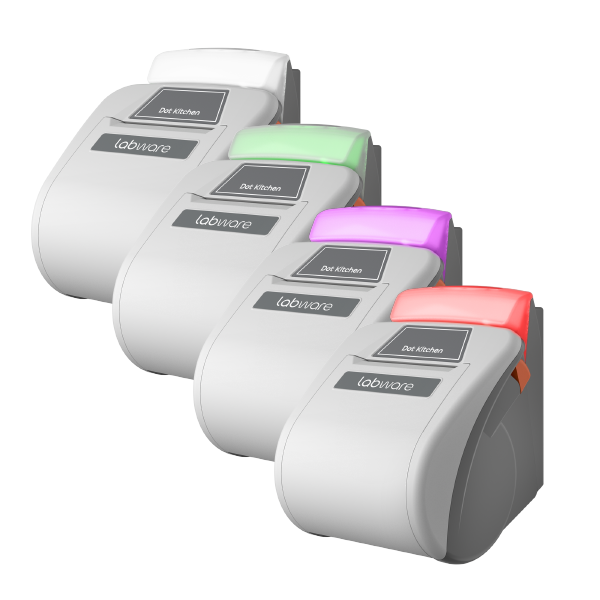

EVERY COLOR HAS A MEANING

DOT Kitchen features a status indicator light which, combined with acoustic signals, identifies the status of the printer, the arrival of an order in the kitchen, or the cancellation of an order.

But let's take a closer look at the color-sound combinations and the meaning of each one.

WHITE LED: The white LED indicates that DOT Kitchen is not connected to any IQ cash register.

GREEN LED (STEADY)The printer is correctly connected to the IQ cash register and is ready to receive orders.

GREEN LED (FLASHING)Orders are coming in. The flashing green LED is accompanied by an audible alert that draws the kitchen staff's attention to the printer, alerting them to the arrival of a new order.

FLASHING PURPLE LED: the flashing purple LED, accompanied by a series of consecutive beeps, indicates a reversal.

RED LED ON: As we know, the color red indicates an error. In this case, the paper may have run out or the print head may be raised.

CONNECTIVITY

DOT KITCHEN connects via Ethernet through a wired LAN local area network.

- Automatic cutter Guaranteed for 1 million cuts and equipped with a special lock-free system that prevents paper jams and printer blockages.

- Easy paper loading together with the large roll (80/78), it simplifies replacement operations, which take only a few seconds

- High-quality thermal printhead Guaranteed for 100 km of printed paper, maximum reliability.

- High printing speed allows for significant time savings in fast-paced and hectic restaurant environments.

- Dimensions (LPH) 5.7 x 4.9 x 4.7 inches

- Front paper output

- Automatic rotary opening for seamless integration in minimal space.

Options:

- Table stand

What is Technological Transition – Industry 4.0?

The Transition Plan 4.0 is the country's new industrial policy, which is more inclusive and focused on sustainability. In particular, the Plan places greater emphasis on innovation, green investments, and design and aesthetic creation activities.

The term Industry 4.0 refers to a trend in industrial automation that integrates certain new production technologies to improve working conditions and increase productivity and production quality in plants.

KEY ACTIONS

TAX CREDIT

FOR INVESTMENTS IN CAPITAL GOODS

Support and incentivize companies that invest in new tangible and intangible capital goods that are functional to the technological and digital transformation of production processes for production facilities located within the country.

TAX CREDIT

RESEARCH, DEVELOPMENT, INNOVATION, AND DESIGN

Stimulate private spending on research, development, and technological innovation to support business competitiveness and promote digital transition processes and the circular economy and environmental sustainability.

TAX CREDIT

TRAINING 4.0

Encourage companies to invest in staff training on topics related to technologies relevant to the technological and digital transformation of businesses.

Industry 4.0 incentives: 2022–2025

Tax breaks for the technological transition of Industry 4.0 have been confirmed for 2022 and will remain in place until 2025. This three-year plan also includes the tourism sector and provides a very useful tool for the modernization of hospitality in Italy.

Tax relief is claimed on the F24 form as a tax credit; the procedures remain unchanged.

enjoyment of the benefit compared to previous years. The tax credit allows the company to

pay less tax as a percentage of the cost of the goods purchased. Goods refer to those goods that are either

both tangible (physical equipment) and intangible (software) materials that enable modernization

technological equipment of the accommodation facility.

Labware and Industry 4.0

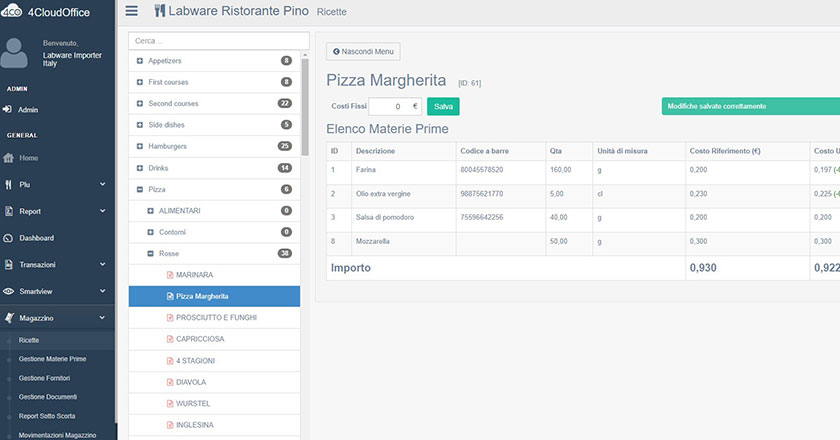

The digitization of business processes also involves the management and supervision of activities and logistics. In this context, it is essential to ensure high technological standards and to collect and manage data from daily operations in order to reduce costs and optimize service efficiency.

The systems LABWARE dedicated to the management and supervision of activities and logistics, including hardware terminals (with embedded SmartTDE and 4FrontEnd software) and 4CloudOffice cloud software, enable the management of activities in the hospitality and retail industries.

These are systems specifically designed to digitize the management of sales and customer service processes, whose general configuration must be designed according to the specific type of activity carried out and the specific type of point of sale.

The characteristics of the assets have been verified in accordance with the requirements set out in Annex A of Law No. 232 of December 11, 2016, No. 232, in order to be able to take advantage of the tax benefits and concessions of the tax credit for investments in capital goods, provided for by Law No. 178 of December 30, 2020, paragraphs 1051 to 1063, and found to be compliant.