Bonus Restaurants, Pastry Shops, and Ice Cream Parlors 2024

CONTENTS:

- Introduction

- What is the MASAF 2024 Restaurant, Pastry Shop, and Ice Cream Parlor Bonus?

- Who is eligible for the Bonus?

- Bonus 2024: what expenses are eligible and what expenses are excluded

- How to apply for the Bonus: procedures and deadlines

- Conclusions

Introduction

2024 brings with it important changes in the landscape of financing and incentives for the food sector. In particular, MASAF (Ministry of Agriculture, Food Sovereignty, and Forestry) has introduced a new bonus dedicated to restaurants, pastry shops, and ice cream parlors, offering significant tax advantages and financing opportunities for businesses in the sector.

The aim is to support and promote the development of catering and food businesses by providing two new important tax breaks, in the form of non-repayable grants of up to €30,000 per business.

The Fund provides two types of assistance:

- “Young graduates”, to finance apprenticeship contracts between companies and young graduates in the food and wine and hotel hospitality sectors.

- “Machinery and capital goods”, to finance the purchase of professional machinery and other durable capital goods

This program is aimed at restaurants, pastry shops, and ice cream parlors, offering them the opportunity to support the purchase of machinery or promote the hiring of young graduates under 30 years of age in the food and wine and hotel hospitality sectors. It is, therefore, an opportunity to improve one's competitiveness in the market.

Continue reading to learn more.

What is the MASAF 2024 Restaurant, Pastry Shop, and Ice Cream Parlor Bonus?

As we have said, the 2024 restaurant, pastry shop, and ice cream parlor bonus is a package of non-repayable grants intended for the Italian food and wine, restaurant, and pastry sectors.

The initiative is financed by the “Funds for the support of excellence in Italian gastronomy and agri-food,” and the government has allocated a total of €76 million for 2024.

This fund is divided between the two subsidies provided for in this way:

- €56 million for machinery and capital goods

- 20 million euros to facilitate the hiring of young graduates under 30 with first-level apprenticeship contracts in food and wine services and hotel hospitality.

Applications for the Bonus can be submitted online from March 1, 2024, until April 30, 2024.

Who is eligible for the Bonus?

The bonus can be requested by companies operating in the restaurant, pastry, and ice cream sectors, classified under the following ATECO codes:

- companies operating in the sector identified by ATECO code 56.10.11 (Catering with administration) duly established and registered as active in the Register of Companies for at least 10 years

- companies operating in the sector identified by ATECO code 56.10.30 (Ice cream parlors and pastry shops) and ATECO code 10.71.20 (Production of fresh pastries) duly incorporated and registered as active in the Register of Companies for at least 10 years

Bonus 2024: what expenses are eligible and what expenses are excluded

The bonus is equal to 70% of eligible expenses and up to a maximum amount of €30,000 per company.

The eligible expenses are:

- expenses related to the purchase of professional machinery and capital goods for the business, which must be new, organic, and functional. Expenses for the purchase of furniture are also eligible, provided that it is organic, functional, and instrumental to the business. Goods lifts and cold rooms may be included among the capital goods eligible for financing, provided that the related cost can be easily separated from other expenses, such as those for building works and similar, which are in any case ineligible. These goods must be purchased at normal market conditions from third parties who have no relationship with the company. Furthermore, the capital goods purchased must be kept on the company's balance sheet for at least three years from the date of granting of the subsidy.;

- the gross remuneration relating to the hiring of one or more young graduates in food and wine services and hotel hospitality with a first-level apprenticeship contract. Young graduates must meet the following requirements:

– have obtained a secondary school diploma from a State Professional Institute for Food and Wine and Hotel Hospitality (IPSEOA) no more than 5 years ago

– be under 30 years of age on the date of signing the apprenticeship contract provided for by the 2024 Restaurant Bonus

The excluding expenses, on the other hand, are:

- the purchase of components, spare parts, or parts of machinery, plants, and equipment that do not meet the requirement of functional autonomy

- land and buildings, including masonry work of any kind, including water, electrical, alarm, heating, and cooling systems

- registered vehicles

- used or refurbished goods

- utilities of any kind, including the supply of electricity, gas, etc.

- taxes and duties

- social security contributions and charges of any kind

- meal vouchers

- legal and notary fees

- consulting services of any kind

- all expenses not directly related to the company's business.

Expenses incurred BEFORE submitting the grant application are NOT eligible.

How to apply for the Bonus: procedures and deadlines

The application for the Bonus can be submitted from March 1 to April 30, 2024, electronically on the INVITALIA portal.

It is necessary to:

- have a digital identity (SPID, CNS, CIE)

- access the reserved area to fill out the application online

- have a digital signature and a certified email address (PEC)

Applications are reviewed in the order they are received..

The estimated expenses must be incurred in full within 8 months of the grant being awarded.

Within 30 days of the date on which the expenses were incurred, the company must submit its application for the payment of the subsidies, attaching:

– copies of electronic invoices;

– payment accountants;

– a final technical report describing the investments made and certifying full payment of the related expenses

SOURCE: www.politicheagricole.it

Conclusions

In conclusion, the new bonus for restaurants, pastry shops, and ice cream parlors offered by MASAF in 2024 represents an unmissable opportunity for businesses in the food sector. Tax breaks and non-repayable grants are designed to support the development and growth of catering and food businesses, providing an incentive to invest in machinery, equipment, and qualified personnel.

If you own or manage a restaurant, pastry shop, or ice cream parlor and want to make the most of this opportunity, we recommend that you learn more about how to access the bonus and the application procedures. Don't miss this chance to grow your business and stay competitive in the market.

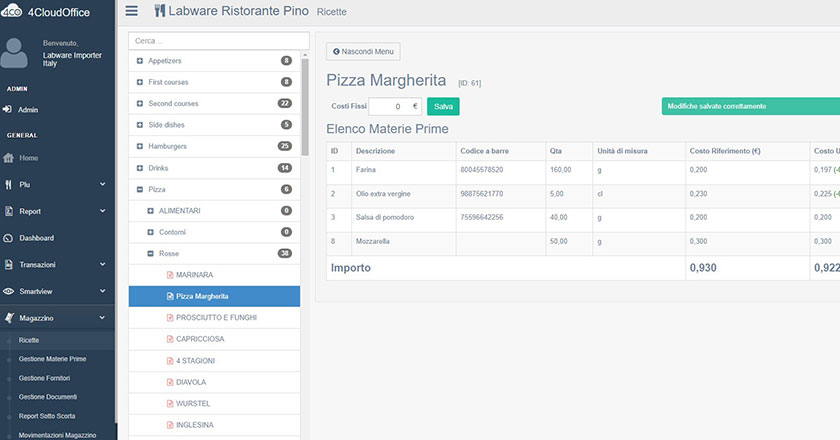

Laboratory equipment offers solutions and services for the catering and retail sectors. Take a look at our website to discover all our products. 👉 www.labware.it

Contact us to learn more