IQ SELF 215 The perfect terminal for self-ordering and payment

- Of communication with the cash register and real-time item updates

- Regarding the issuance of the tax and digital receipt

- Of electronic payment chip card and contactless with credit cards and smartphones

Elegant design and a wide range of accessories for an amazing experience.

Fast, easy, and intuitive.

IDEAL FOR THE CATERING AND HOSPITALITY SECTOR

IQ SELF 215 is the perfect solution to improve service and offer customers the opportunity to view the menu, check out any current promotions, order, and pay directly with debit cards, credit cards, Apple Pay, and Google Pay.

Simplified interactions at your point of sale

Enhance your customers' experience with the intuitive all-in-one ordering and payment system. IQ Self 215 allows you to be flexible and fast in taking orders in self-service mode; increase and simplify interaction with your customer and involve them in the shopping experience.

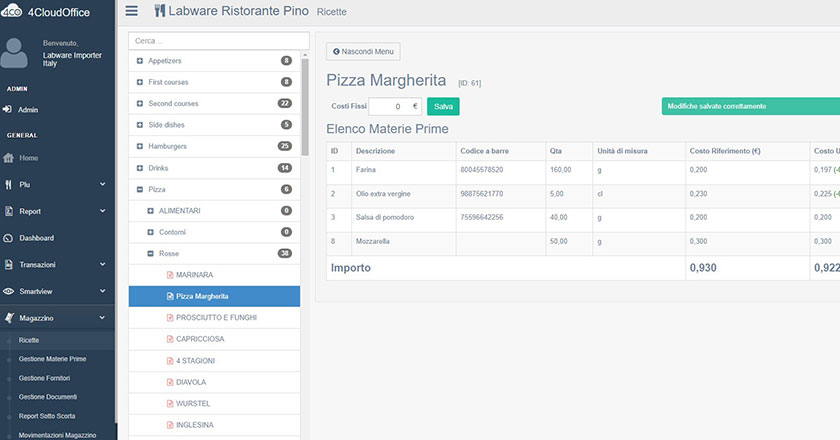

Simplified management and maximum integration with all Labware products

The management of IQ SELF from Cloud Office allows you to have detailed reports on the sales channel and to check its operation whenever you want. From Cloud Office and the cash register, add photos of your products and dishes, customize and enter your menus and promotions to be displayed on IQ SELF 215.

Maximum freedom and numerous color combinations to suit your business and ensure the best shopping experience for your customer.

COMPACT DESIGN AND ATTRACTIVE LINES

Whatever your setting, IQ SELF 215 blends perfectly into your environment and adds a touch of style. Thanks to its compact size and simple, bold lines, IQ SELF fits perfectly with the style of your store, whether you have an ice cream parlor or a fast food restaurant. Available in a neutral white tone, it is a discreet and elegant element for any location.

PERFECT INSTALLATION FOR ALL YOUR NEEDS

You can install IQ SELF in different modes, allowing you to maximize the space available inside your premises. We know very well that every store has its own needs, and IQ SELF is ready to meet them all.

IQ Self allows different installation methods:

- on the wall, using the dedicated bracket (to be purchased separately)

- supported on a flat surface with the addition of an anti-tip base (to be purchased separately)

- free-standing with floor mounting

- Self-standing on metal base with integrated wheels and feet

Each configuration has its own accessory kit tailored to create a system customized for every need.

4KIOSK, THE FRONT-END SOFTWARE FOR MANAGING YOUR IQ SELF 215

4KIOSK is Labware's cloud service that allows you to manage and monitor your IQ SELF 215.

- Independent order taking for takeaway and table service

- From the 4Cloud Office portal, it is possible to monitor receipts and orders coming from the kiosk.

- Allows you to manage paper or digital receipts without request customer data such as email

- Transmission of orders and requests directly to the cash register system and related production centers

TECHNICAL SPECIFICATIONS

- Ultra-compact and attractive design, available in white

- Multitouch display 21.5” full HD with Anti Fingerprint

- Stereo speakers

- Native and integrated RT printer (optional non-fiscal printer)

- Reader of Integrated QR Code

- Reader of native contactless NFC payments

- Status indicator light

- Ready for the management of digital receipt

- Ultra-compact and attractive design, available in white

- Multitouch display 21.5” full HD with Anti Fingerprint

- Stereo speakers

- Native and integrated RT printer (optional non-fiscal printer)

- Reader of Integrated QR Code

- Reader of native contactless NFC payments

- Status indicator light

- Ready for the digital receipt management

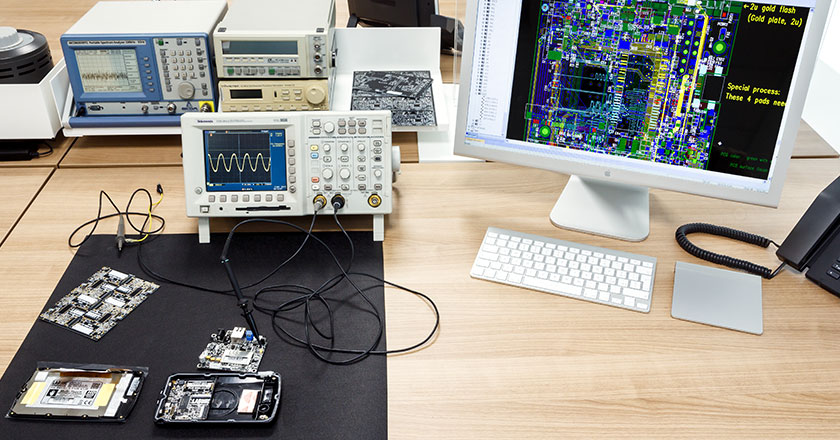

What is Technological Transition – Industry 4.0?

The Transition Plan 4.0 is the country's new industrial policy, which is more inclusive and focused on sustainability. In particular, the Plan places greater emphasis on innovation, green investments, and design and aesthetic creation activities.

The term Industry 4.0 refers to a trend in industrial automation that integrates certain new production technologies to improve working conditions and increase productivity and production quality in plants.

KEY ACTIONS

TAX CREDIT

FOR INVESTMENTS IN CAPITAL GOODS

Support and incentivize companies that invest in new tangible and intangible capital goods that are functional to the technological and digital transformation of production processes for production facilities located within the country.

TAX CREDIT

RESEARCH, DEVELOPMENT, INNOVATION, AND DESIGN

Stimulate private spending on research, development, and technological innovation to support business competitiveness and promote digital transition processes and the circular economy and environmental sustainability.

TAX CREDIT

TRAINING 4.0

Encourage companies to invest in staff training on topics related to technologies relevant to the technological and digital transformation of businesses.

Industry 4.0 incentives: 2022–2025

Tax breaks for the technological transition of Industry 4.0 have been confirmed for 2022 and will remain in place until 2025. This three-year plan also includes the tourism sector and provides a very useful tool for the modernization of hospitality in Italy.

Tax relief is claimed on the F24 form as a tax credit; the procedures remain unchanged.

enjoyment of the benefit compared to previous years. The tax credit allows the company to

pay less tax as a percentage of the cost of the goods purchased. Goods refer to those goods that are either

both tangible (physical equipment) and intangible (software) materials that enable modernization

technological equipment of the accommodation facility.

Labware and Industry 4.0

The digitization of business processes also involves the management and supervision of activities and logistics. In this context, it is essential to ensure high technological standards and to collect and manage data from daily operations in order to reduce costs and optimize service efficiency.

The systems LABWARE dedicated to the management and supervision of activities and logistics, including hardware terminals (with embedded SmartTDE and 4FrontEnd software) and 4CloudOffice cloud software, enable the management of activities in the hospitality and retail industries.

These are systems specifically designed to digitize the management of sales and customer service processes, whose general configuration must be designed according to the specific type of activity carried out and the specific type of point of sale.

The characteristics of the assets have been verified in accordance with the requirements set out in Annex A of Law No. 232 of December 11, 2016, No. 232, in order to be able to take advantage of the tax benefits and concessions of the tax credit for investments in capital goods, provided for by Law No. 178 of December 30, 2020, paragraphs 1051 to 1063, and found to be compliant.