POS AND TELEMATIC RECORDERS: FROM JANUARY 1, 2026, CONNECTION WILL BE MANDATORY

The 2025 Budget Law (Law No. 207/2024) introduces a significant change for the world of commerce and services: Starting January 1, 2026, all merchants will be required to connect their electronic cash registers (RT) to electronic payment devices (POS).

The aim of the measure is to strengthen the traceability of payments and simplify the flow of tax data by integrating receipt recording and payment transactions into a single system.

What's newregulations

This obligation derives from paragraphs 74-80 of Article 1 of the 2025 Budget Law, which amend Legislative Decree 127/2015.

Under the new system, every transaction made via POS must be automatically linked to the electronic recorder, thus ensuring that payment data is stored and transmitted in real time to the Internal Revenue Service.

What this means for merchants

The obligation does not necessarily translate into a “physical” connection between the POS and the cash register, but rather into a functional or virtual integration between the two systems.

The operator (including through an intermediary) must access their reserved area and associate the serial number of the electronic recorder already registered in the Tax Registry the identification details of the electronic payment instruments held by him/her.

Those who fail to comply risk administrative penalties ranging from €1,000 to €4,000 in the event of failure to connect or transmit data.

Preparing in advance is essential to avoid disruptions, penalties, or unexpected costs when the obligation comes into force.

The benefits of integration

The interconnection between POS and electronic cash registers represents a decisive step towards the digitization of sales processes.

Among the most obvious benefits:

- reduction of errors in the transmission of payments;

- greater transparency in payments;

- full traceability of transactions;

- simplification of tax audits;

- reduced administrative time.

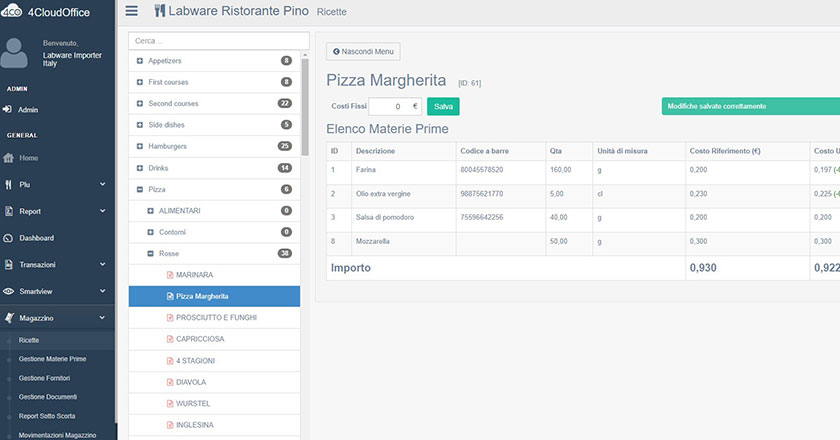

Labware is ready: native integration between cash register and POS

Labware cash registers and management systems are already set up for automatic communication with payment terminals.

Thanks to the amount exchange, the POS is automatically activated with the corresponding figure, without having to re-enter the data manually.

All cash register systems are also integrated with other electronic payment methods that do not require a physical terminal, such as Satispay, Apple Pay, or Google Pay.

This integrated system:

- reduces checkout times;

- eliminate errors transcription;

- ensures that the receipt matches the payment;

- complies with the traceability requirements of the new legislation.

In other words, Labware solutions already meet the standards set for 2026, allowing merchants to anticipate requirements and work with modern, reliable, and compliant tools.